Nakup IP68 Vodotesen LED Podvodna Luč, Svetilka 12V RGB Spot Luči Swiming Bazen Fish Tank Akvarij Vrt Fontane Reflektorji - Led Svetilke > www.zveza-sup.si

Nakup IP68 Vodotesen LED Podvodna Luč, Svetilka 12V RGB Spot Luči Swiming Bazen Fish Tank Akvarij Vrt Fontane Reflektorji - Led Svetilke > www.zveza-sup.si

Led Meduze Akvarij Svetilko Ob Postelji Noč Svetlobe 7 Barva Spreminja, Neverjetno Led Svetilke Z Odlično Ples Meduze Razpoloženje Luči Akcija - Led svetilke | Hudastena.si

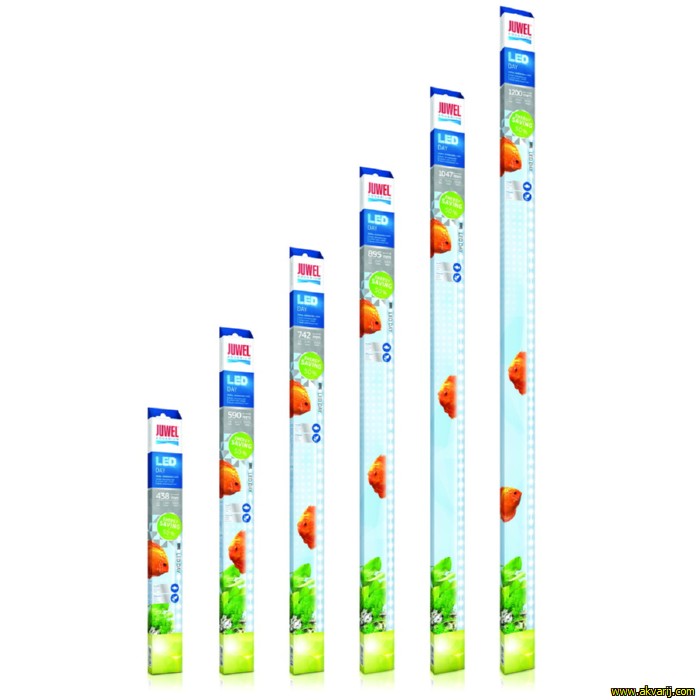

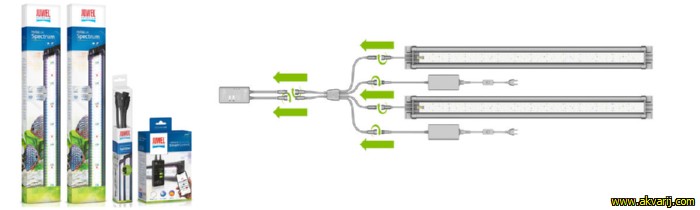

Led Luči Akvarij Fish Tank Razsvetljave Svetilke Z Raztegljivim Oklepajih Primerni Za Akvarij Decro nakup - trgovina | www.klubsasa.si

Led luči akvarij vodnih rastlin lučka z nami plug super slim dvakrat zapored nepremočljiva 20-50 cm posnetek na svetilka za fish tank Na razprodaji! ~ Led osvetlitev / www.pgd-zalog.si

KARWEN Lampada LED svetilka MR16 GU10 E14 E27 AC 220V 240V 230V 48LEDs 60LEDs 80LEDs Hladno Toplo Whtie LED Žarnice Pozornosti | Center ~ www.evelinecoaching.si

Zložljiva Prenosna Lučka Led Bar Fotografija Mehke Svetlobe Polje Svetlobe Svetlobni Trakovi popust | popust > www.goodyear20poti.si

Led luči akvarij vodnih rastlin lučka z nami plug super slim dvakrat zapored nepremočljiva 20-50 cm posnetek na svetilka za fish tank Na razprodaji! ~ Led osvetlitev / www.pgd-zalog.si